What does the 2023 Spring Budget mean for you?

27.03.2023

27.03.2023

Chancellor of the Exchequer, the Rt Hon Jeremy Hunt MP delivered his Spring budget on 15 March 2023, which promised to be a “Budget for Growth”. He announced that the UK is avoiding a recession and that the OBR (Office for Budget Responsibility) predicts that the CPI inflation rate will fall from 10.1% (January 2023) to just 2.9% by the end of 2023. If this proves to be correct, it is good news for both businesses and individuals as our money will go further.

Set out below are some of the most relevant highlights and changes, which may affect you or your business.

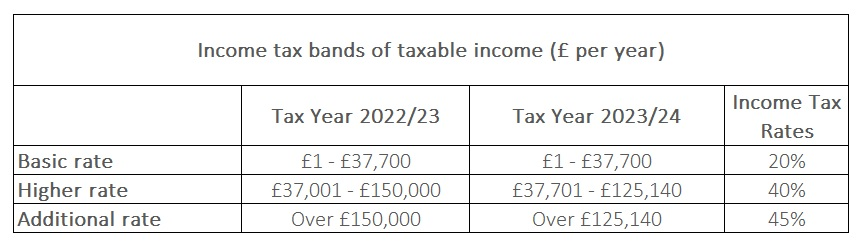

Income tax

Tax rates for the forthcoming tax year commencing 6 April 2023 are as follows (NB Scottish tax rates are not shown): -

Personal allowance, saving rates and dividend rates remain unchanged with an increase in the income limit for married couples allowance for lower earners.

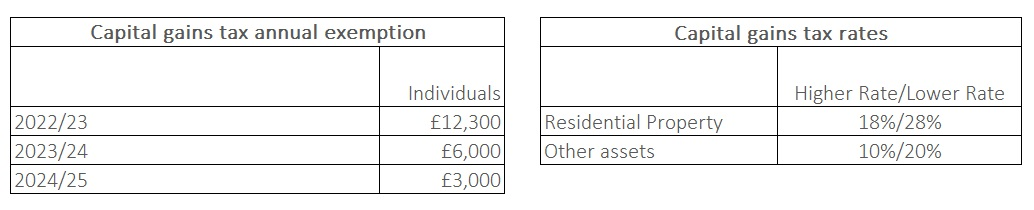

Capital Gains Tax (CGT)

Capital allowances

It’s worth noting that one type of capital allowance, the Annual Investment Allowance, is normally £200,000 in a year. This has been increased indefinitely to £1 million.

Corporation Tax

The proposed increase in corporation tax will come into effect on 1 April 2023, which means that companies with profits over £50,000 will pay tax at a rate of between 19% and 25%.

Free Childcare

The Chancellor announced new measures to help parents with the rising cost of childcare in England, which often prevents parents’ start or return to work.

The measures announced include plans to increase the number of registered childminders, increase funding to providers of free childcare, change the minimum staff-to-child ratio from 1:4 to 1:5, and increase ‘wrap-around’ care for school-age children.

The significant changes to subsidised childcare, for eligible households, will be phased in from April 2024 for 2-year-olds, enabling access of 15 hours of free childcare a week. By September 2025 eligible families will be able to access up to 30 hours of free childcare a week for working parents, for all children from the age of nine months.

Pension Reform

Lifetime Allowance (LTA)

The Chancellor announced the abolition of the LTA. The 55% and 25% rates of tax applied when the Lifetime allowance for pension savings is exceeded will be reduced to 0% with effect from 6 April 2023. As a consequence, nobody retiring from that date forward will incur an LTA charge.

Annual Allowance (AA)

For 2023/24, the Annual Allowance for pension contributions is increased from £40,000 to £60,000. The AA tapering for threshold income still applies but now means that the minimum Annual Allowance is increased from £4,000 to £10,000. To read more detail on this, please see Jenny Stone’s article “Is it time to rethink your NHS Pension?”.

Other Highlights

To listen to our latest podcast on the Spring Budget, please click here.