The Medical Profession… Self-Employed Travel

16.04.2019

16.04.2019

Over the last few years, HMRC have raised many investigations relating to the tax affairs of medical practitioners, and in particular, their self-employed travel.

For example, a self-employed geriatrician who is based at home, but regularly travels on specific days each week to set hospitals, would not get his travel from “home to hospital” allowed as a deductible expense for taxation purposes.

HMRC are quite strict in this area, and have frequently been investigating self-employed doctors and others in this connection. They go back up to 6 years and can revise and increase the taxable profits owing to the now disallowed self-employed travel.

HMRC quote one very well-known case, which they won, namely Samadian v HMRC (Upper Tier Tribunal Decision) in 2014.

We look at the facts of the Samadian case below.

Samadian V HMRC (Upper Tier Tribunal Decision) (2014) [BTC 504]

Full time employment Part time | Part time |

NHS (Two hospitals) at St Anthony’s | Every Wednesday afternoon at Parkside |

/\ private hospital | /\ private hospital |

| varied meetings | | |

| /\ | | |

| | | | | | Dr Samadian Dr Samadian | | | | Dr Samadian |

Employee Consultant | Consultant |

Dr Samadian was a geriatrician. He worked full time for the NHS. In addition, he held set weekly out-patient clinics at a private hospital, namely ‘Parkside’, every Wednesday afternoon.

He hired out-patient consulting rooms at Parkside hospital, for a three hour duration, for scheduled sessions. His nameplate was temporarily placed on the door during these sessions. If the patients were subsequently admitted to hospital, they remained under the care of Dr Samadian.

He also worked privately at another hospital, St. Anthony’s. However, this work was intermittent, i.e. no set pattern, and he worked there as and when needed.

Occasionally, Dr Samadian saw the patients at their homes or other care locations such as a nursing home.

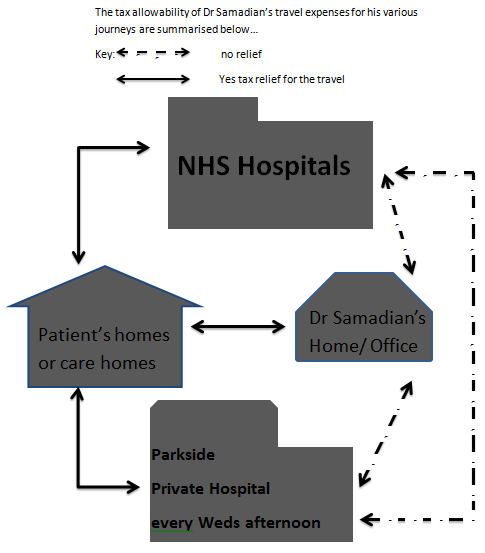

HMRC reviewed his self-employed travel and came to the following conclusions:

His travel expenses between his home and the private Parkside hospital were not allowable.

His travel expenses for journeys between the NHS hospitals and the Parkside private hospital were not allowable.

His travel expenses for journeys between the NHS hospitals and a patient’s home or nursing home were allowable.

His travel expenses for journeys from his home to see a private patient at their home or other care location, (such as a nursing home) were allowable.

His travel expenses to St. Anthony’s Hospital were allowable.

Dr Samadian had a ‘pattern of regular and predictable attendance, in order to perform his professional functions as a geriatrician at the Parkside private hospital.

With regard to his travel from home to the Parkside private hospital and back, the tribunal came to the decision that there must have been a ‘mixed object’, regarding his travel, with at least part of his motive being to live away from the Parkside hospital.

Accordingly, HMRC disallowed his costs of the journeys between Dr Samadian’s home and theParkside private hospital, and also the costs of the journeys between the NHS hospitals and the Parkside private hospital.

The Tribunal decided that Dr Samadian needed ‘a home in which to live and carry on his own private life’, and it was an inevitable feature of his journey home in the evening from the Parkside private hospital that part of his purpose was to get home in order to advance his private non business interests.

With regard to the outward journey from his home to the Parkside private hospital, this was made to enable him to maintain his home where he chose and away from the places where he carries on his business in a predictable and fixed way.

Summary of Dr Samadian’s journeys, and their allowability as a trading deduction.

Illustration of a questionnaire for medical clients, re self-employed travel…..

RBP, Chartered Accountants take on a new surgeon client.

They give him a questionnaire, including some of the following questions: