Is it time to rethink your NHS Pension?

27.03.2023 , BY Jenny Stone

27.03.2023 , BY Jenny Stone

The Chancellor, Jeremy Hunt, announced two major changes to pensions in his recent budget which means that doctors, who had previously opted out of the NHS Pension Scheme may want to consider if this is still the right option for them, in light of the changes announced.

Lifetime Allowance (LTA)

The lifetime allowance is the total amount you can save in your pension pot over your lifetime, the limit had previously been frozen at £1,073,000. This limit will now be abolished from 6th April 2023, meaning there is no cap on how much you can save in your pension during your lifetime. Many doctors opted out of the NHS Pension Scheme when they reached the lifetime limit, even though they were not at retirement age. Now the limit has been abolished, doctors may want to re-consider opting back in and continue to grow their pension for retirement. The capped lifetime limit meant GPs could have about £46,000 annual pension benefits.

There are many doctors who have applied to take their NHS pension at 31st March 2023, by doing this they will be subject to a lifetime tax charge if their pension pot is over the £1,073,000 limit. Although PCSE and NHS Pensions may not have processed your AW8 yet, if you have put down a retirement date before 6th April 2023, the lifetime limit of £1,073,000 will be applied and any lifetime tax charge will be calculated and your pension will be backdated to your chosen retirement date.

Given the announcement that the limit has been abolished it would be worth contacting PCSE and NHS Pensions to see if your retirement date can be delayed until after 6th April 2023.

The change to the limit comes in from 6th April 2023 and takes affect for anyone taking their pension after this date, so unfortunately, for those doctors who have already taken their pension and been subject to a lifetime tax charge, there is nothing you can do retrospectively.

Maximum Tax-Free Lump sum

Normally you are able to take 25% of your lifetime allowance as a lump sum, however now the lifetime limit has been abolished, the maximum tax-free lump sum you can take is retained at the current level of £268,275.

Annual Allowance (AA)

The annual allowance is the amount of growth you can have in your pension each year, tax free. If the growth in your pension exceeds the annual allowance you are subject to a tax charge at your highest marginal rate. From 6th April 2023, this allowance will increase from £40,000 to £60,000.

Also, the inflation disconnect which created more growth in the calculation of the annual allowance where there was a significant rise in inflation has been adjusted. Previously we were estimating many GPs would have six figure growth amounts for 2022/23 as a result of the rise in inflation, but now the growth will be calculated based on actual growth in your pension rather than taking into account the growth in inflation. This change comes in from 2022/23, but the increase in the annual allowance will be from 6th April 2023.

Many doctors opted out of the NHS Pension Scheme as they were subject to large annual allowance tax charges, some doctors also do the “Hokey Cokey” where they opt in and out of the NHS Pension scheme during the year. As a result of the increase in the annual allowance and the inflation disconnect being adjusted, you may want to reconsider if you still want to remain opted out, given the cap on lifetime allowance has been removed too. See examples below.

This may also mean that doctors who have an annual allowance of less than £60,000 will have unused allowance which can be carried forward for three years. This may give the opportunity for you to consider making further pension contributions especially as the lifetime limit has been abolished.

Tapered Annual Allowance

From 6th April 2023, the tapered annual allowance will increase from £4,000 to £10,000 and the adjusted income threshold will increase from £240,000 to £260,000. If your taxable income from all sources is over £200,000 and your adjusted income is over £260,000 then the annual allowance of £60,000 will be subject to the taper. Once your adjusted income is over £360,000 you will only have an annual allowance of £10,000.

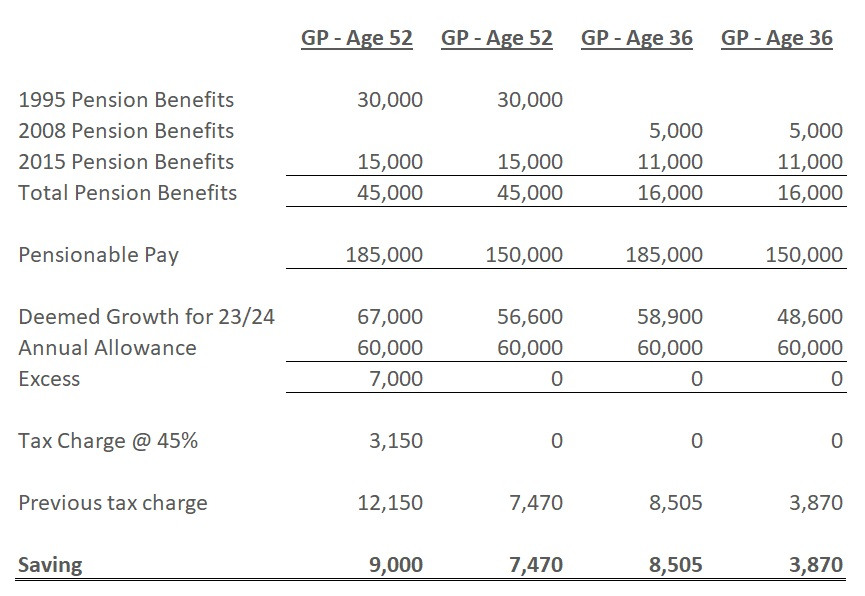

Examples of annual allowance charges for 2023/24

Below are examples of GPs deemed growth and annual allowance tax charges for 2023/24, the previous tax charge is if the annual allowance remained at £40,000. From these examples, an older GP with higher pensionable pay may still have a tax charge but this will be less than it would have been previously.

Negative Growth

If you have negative growth in say the 1995 scheme and positive growth in the 2015, previously the 1995 growth would have been deemed zero. From 6th April 2023, the negative growth in one scheme can be offset against the positive growth in the other scheme.

Other Changes to the NHS Pension Scheme

Following the recent consultation on the NHS Pension Scheme relating to retirement flexibilities and access to the scheme, below is a summary of what is changing: -

Our pension information report will be updated for these changes and if you are interested in this service, please see link https://www.rbp.co.uk/report

If you are looking for Independent Financial Advice about your pension, please contact us and we can put you in touch with a specialist IFA who understands the NHS Pension Scheme.