How to deal with Salaried GP (Type 2) End of Year Pension Superannuation Adjustments

08.04.2021 , BY Jenny Stone

08.04.2021 , BY Jenny Stone

It’s that time of year again, when you start to see end of year (EOY) superannuation adjustments on the NHS Open Exeter Statements. The partner’s EOY superannuation shortfalls are straightforward as these are provided in the accounts and you are usually aware of the amounts. However, it is the EOY adjustments relating to salaried GPs type 2 certificates that seem to generate the most queries, as there is a lot of misunderstanding as to how these should be dealt with. The reconciliation of salaried GPs’ superannuation is a two-step process.

What is a type 2 certificate and who completes this?

Every salaried GP is required to complete a type 2 pension certificate each year and submit it to PCSE by 28th February. The purpose of this certificate is to ensure that the salaried GP has paid the correct employee’s tier rate on all their NHS pensionable earnings. The tier rate is not based on whole time equivalent like other employed staff members but is based on the total of all their NHS pensionable income. The type 2 certificate should be completed with the pensionable pay from each post and the employee’s pension contributions that the GP has paid, i.e. what has been deducted from their monthly pay via the payroll.

It is the responsibility of the salaried GP to complete the certificate and not the responsibility of the practice manager, as they are unlikely to know what other earnings the salaried GP has.

Step 1 – Salaried GP – Under or Over payment of employee contributions

Once a salaried GP has completed their end of year certificate and submitted it to PCSE, they should give a copy of the certificate to the practice manager so that any under or over payment of employee contributions can be dealt with in the next pay run.

An adjustment will be required if the incorrect tier rate was used when calculating the monthly employee deductions from the payroll.

For example, a salaried GP earns £60,000 working at practice A, the practice deducts employee contributions via the payroll at a rate of 12.5%, so, total employee contributions paid via the payroll is £7,500. However, this GP also earns £20,000 doing locums which are pensioned via the Locum A and B forms. The total pensionable pay is £80,000, this means when the type 2 certificate is completed, the tier rate based on total NHS pensionable income should be 13.5%.

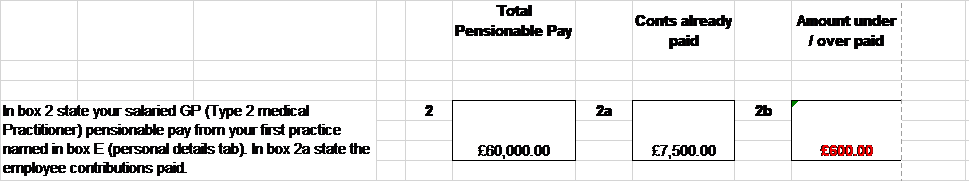

Therefore, as practice A deducted employee contributions at 12.5% and not 13.5%, the salaried GP would owe practice A, £600 in underpaid contributions, this would be shown on the certificate as follows: -

Practice A will need to make sure they recover the £600 from the salaried GP via the payroll. As this is superannuation, the salaried GP should receive tax relief on this. If they have since left the practice, they should pay Practice A the amount owed of £600 and then claim this amount as a pension payment on their tax return.

Step 2 – Practice reconciliation – EOY Adjustment

In a lot of cases, what is deducted via the payroll as employee contributions is never the same as the deductions made by PCSE throughout the year! This may be due to a new salaried GP joining and PCSE not making superannuation deductions, or incorrect estimates of the salaried GP pay if this has changed due to a change in sessions. There are many reasons why they are not the same, but this does mean PCSE need to carry out their reconciliation and collect any shortfall.

Once PCSE process the type 2 certificate, they will compare the actual amount of superannuation due on the pensionable pay to what they have collected from the practice. This will include both employee’s and employer’s contributions. The difference will appear on the Open Exeter Statement as the EOY adjustment.

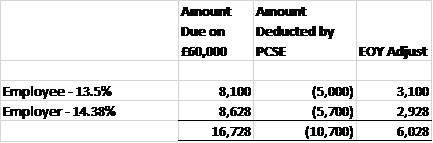

In the example above, PCSE had deducted from practice A employee contributions of £5,000 and employer contributions £5,700, so the EOY adjustments for the type 2 certificate for this salaried GP is as follows: -

What to do when you have Type 2 EOY Adjustments

We are often asked if the EOY adjustment that is deducted or refunded should be paid by (or to) the salaried GP. If you have any EOY adjustments for salaried GPs appearing on the Open Exeter Statement, then you should ask for a copy of the type 2 certificate so you can see what adjustment is required from the salaried GP.

It is advisable to request a copy of the type 2 certificate from all your salaried GPs each year, even if they left during the year so that you can recover any money that you are owed.

From our experience, based on the enquires we get from both practices and salaried GPs, this is an area that is not fully understood. Many salaried GPs still do not complete the type 2 certificate, and if they are not completed, then PCSE will not correctly update their NHS pension record resulting in the salaried GP having an incomplete pension record.

At RBP, when we are preparing the practice accounts, we will make provisions for the EOY adjustments for salaried GPs as we compare the amount deducted per the payroll to what PCSE have deducted. The salaried GP would have to repay any amount owed in respect of the correct contributions due to what was deducted per the payroll.

It is also really important that estimates of pensionable pay are submitted each year and updated during the year if the annual salary changes and that you check with your salaried GPs if they have any other earnings that would affect their tier rate. This would then ensure that the correct tier rate is being used for the employee deductions via the payroll and so minimise EOY adjustments.