How the GP Contract changes will impact on practice profits

31.03.2022 , BY Jenny Stone

31.03.2022 , BY Jenny Stone

Many practices saw an increase in profits over the last two years due to income streams being protected, extra support funding to help with Covid and taking part in providing Covid vaccinations. However, the outlook for 2022/23 is going to be very different. The GP contract announcements are intended to give GP practices an increase in funding of 2.1%, but with no additional funding to cover the increase in employers’ NI and with costs increasing as a result of the rise in inflation it is likely that practices could see a drop in profits for 22/23.

Funding Changes for Practices

The global sum will increase from £96.78 to £99.70, an increase of £2.92 per weighted patient which represents a 3% uplift.

The cost of opting out of hours will increase from £4.59 to £4.73 per weighted patient, which means that the net global sum funding will only increase by £2.78 per weighted patient!

The quality and outcomes framework (QOF) will be fully reinstated from April 2022, there are no changes to indicators and the amount each point is worth will increase from £201.16 to £207.56 to reflect the changes in the average number of patients.

National Insurance Increase

From 1st April 2022 National Insurance will be increasing by 1.25%. This means that the employers’ NI that a practice pays for all the staff on their payroll will increase from 13.8% to 15.05%. This is likely to cost an average practice with 10,000 patients between £7,000 and £9,000. However, depending on the ratio of partners to salaried GPs, this cost could be higher. No additional funding has been given to GP practices to cover this increased cost, despite the intention to cover this cost for all other public services including secondary care.

PCN Changes

The additional roles reimbursement scheme (ARRS) funding will increase from £746m in 21/22 to £1.027bn in 22/23. However, if PCNs do not utilise this funding, it will be lost. This may not be through lack of trying to recruit but more due to the lack of available staff to fill the roles being offered.

PCNs will continue to be paid £1.50 core funding per weighted patient which is to cover the cost of running the PCN.

The funding for extended hours of £1.44 and extended access of £6 per patient will be combined into a new extended access DES worth £7.46. From October 2022, this funding is to cover PCNs providing bookable appointments, weekdays from 6.30pm to 8pm and Saturdays from 9am to 5pm. PCNs will be expected to provide 60 minutes per 1,000 patients.

The planned personalised care and anticipatory care service has been delayed.

The investment and impact fund (IFF) will be uplifted from £150m to £260m and the value of a IFF point remains at £200.

PCN Clinical Directors

The funding for clinical directors has been agreed at £0.736 per patient plus the additional funding amounting to £43m has been extended for one more year.

There has been no formal decision from HMRC about the taxation of clinical directors of a PCN that is not a legal entity. However, many PCNs are starting to incorporate as limited companies and in these cases the clinical director will need to be put on the payroll of the company. This will incur the additional cost of employers’ NI at 15.05% and employers’ pension at 14.38%. Consideration will need to be given by the PCN as to whether this cost will be covered by the core funding.

New to Partnership Scheme

We have seen an increase in new partners joining practices and being able to claim the new to partnership payment. This scheme has been extended to March 2023 and the requirement to apply within six months if joining has been removed. The scheme enables new partners to general practice to claim £20,000 plus a contribution towards on-costs of up to £4,000 per full time equivalent as well as up to £3,000 in a training fund.

Changes to Superannuation Tier Rates

Following the NHS consultation, the tier rates for superannuation contributions will be changing from October 2022. This will see the top tier rate of 14.5% for pensionable earnings over £111,377 reduce from 14.5% to 13.5% and to 12.5% from April 2023.

Impact on Profits and Partners’ Drawings

When planning partner drawings for the forthcoming year, consideration will need to be given to the level of profits taking into account increasing costs such as staff pay rises, employers’ NI, heat and light and a general rise in costs as a result of level of inflation which is currently 6.1% and expected to rise further.

Example of Impact of Contract Changes on profits

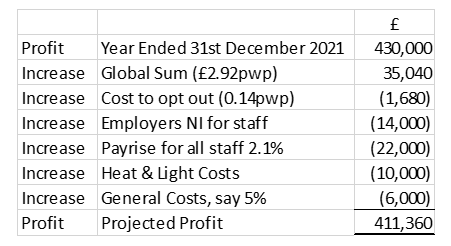

This practice has a weighted list of 12,000 patients, below is a projection of the impact of the contract changes and potential increase in costs including giving staff a 2.1% pay rise.

Although the GP contract changes were intended to give GPs a 2.1% pay increase, for the above practice example, they could see a drop in profits of 4.5%! so, ensuring income is being maximised where possible and managing expenses is going to be crucial for the next year on top of managing increasing demand from patients.