Health and Social Care Levy

15.12.2021 , BY John Holmes

15.12.2021 , BY John Holmes

The Health and Social Care Levy Bill was announced on 7 September 2021. It will provide for a 1.25% levy to be paid on earnings or profits on which employees, employers and self-employed taxpayers are already liable to pay national insurance contributions (NICs). In addition, the income tax rate applicable to dividends will increase by 1.25%.

The new levy will take effect from 6 April 2022.

Collection of the levy

The initial method of collection will apply for the first 12 months before being superseded, such that:

In monetary terms, the impact on taxpayers of both collection methods will be identical. The only difference, aside from a change of name on 6 April 2023, is that the levy will start to affect those who are above state pension age.

Impact of the levy

The impact of the levy on take-home pay from the 2022/23 tax year onwards will obviously be dependent on a taxpayer’s specific circumstances. For clients who are concerned about the new charge and how it might affect them, your usual contact in the tax team at RBP will be happy to discuss this with you.

In the meantime, we thought it might be helpful to provide a couple of examples for reference.

Example 1 (Director/shareholder)

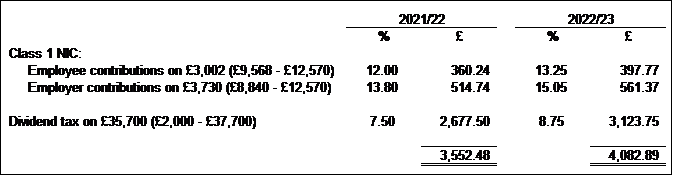

The income tax and NICs which will be due on Dr A’s income in 2021/22 and 2022/23 (assuming other rates remain unchanged) can be broken down as follows:

The overall increase in this case amounts to £530.41 (or just under 15%).

Example 2 (GP Partner)

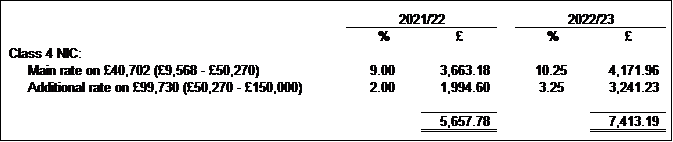

The NICs which will be due on Dr B’s income in 2021/22 and 2022/23 can be broken down as follows:

The overall increase in this case amounts to £1,755.41 (or just under 31%).