Budget Announcement re Pensions – Changes to the Tapered Annual Allowance

02.04.2020 , BY Jenny Stone

02.04.2020 , BY Jenny Stone

The long-awaited budget, on 11th March 2020, finally brought some good news for the many members of the NHS Pension Scheme who have been affected by the tapered annual allowance, resulting in large tax charges. The changes announced to the income levels for when the tapered annual allowance will apply means that many doctors who are currently affected by these limits will escape the taper. However, they may still have annual allowance tax charges if their pension has grown by the standard annual allowance of £40,000.

What is the annual allowance?

The annual allowance is the amount you can contribute into a pension scheme in each tax year without incurring a tax charge. The standard annual allowance is £40,000. For GP members of the NHS Pension scheme, your actual pension contributions are ignored and instead, a ‘deemed growth’ in your pension over the tax year is calculated.

If your pension has grown by more than the annual allowance in the tax year, you will have an annual allowance tax charge on the excess.

What is the tapered annual allowance?

The annual allowance of £40,000 is tapered down if threshold income (taxable income) is more than £110,000 and adjusted income (taxable income plus pension growth) is more than £150,000. The £40,000 is tapered by £1 for every £2 adjusted income is over £150,000, resulting in a minimum tapered allowance of £10,000.

What were the changes announced in the budget?

From 2020/21, the threshold and adjusted income limits will increase by £90,000 each. The threshold income (taxable income) will rise from £110,000 to £200,000 and the adjusted income (taxable income plus pension growth) will rise from £150,000 to £240,000.

However, for the very highest paid with adjusted income over £312,000, the annual allowance will be tapered down to only £4,000 (previously £10,000).

What happens if I have exceeded the annual allowance?

If your pension has grown by more than the tapered or standard annual allowance, you will have an annual allowance tax charge on the excess growth at your highest marginal tax rate.

Example of the effect of the budget changes

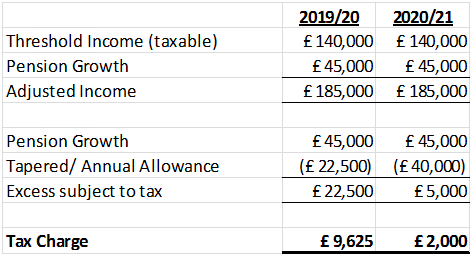

A GP had taxable income of £140,000 and pension growth of £45,000 with no unused annual allowance to carry forward. The changes announced in the budget would reduce the tax charge payable from £9,625 to £2,000, an overall saving of £7,625.

How do I pay the tax charge?

If you have an annual allowance tax charge, this will need to be declared on your tax return and the tax will be payable in the following January. However, you can elect for NHS Pensions to pay the tax charge on your behalf but making a ‘Scheme Pays’ election means NHS Pensions are effectively giving you a loan to be paid back when you take your pension. They will charge interest and then recover the tax paid and interest from your pension benefits when you retire. Deadlines for ‘Scheme Pays’ elections apply so it is important that if you wish to make a ‘Scheme Pays’ election this is done before the deadline, which for 2018/19 is 31st July 2020.

How do I know if I have exceeded the annual allowance?

NHS Pensions will send you an annual allowance statement confirming the growth in your pension during the tax year. However, for GPs, your accountant will need to make an estimate of your annual allowance tax charge as your final annual allowance statement will not be available before either the tax return filing deadline or ‘Scheme Pays’ election deadline. Therefore, an estimate will need to be declared on your tax return and for those wishing to make a ‘Scheme Pays’ election, a provisional ‘Scheme Pays’ form can be submitted. You have four years in which to amend a provisional ‘Scheme Pays’ election.

Do these changes announced affect the previous announcement regarding the tax charge for 2019/20 being paid?

The changes announced in the budget are from April 2020 onwards. This means the tapered annual allowance threshold income of £110,000 and adjusted income of £150,000 still apply. However, the Government did announce that members of the NHS pension scheme who have a tax charge in 2019/20 and who make a ‘Scheme Pays’ election for that year will be compensated at retirement for this reduction in the pension. However, the details of how GPs would be compensated at retirement have not been announced.

What about the pension flexibilities consultation?

The changes announced to the tapered annual allowance in the budget are in response to the pension flexibility consultation. So proposals regarding choosing a percentage of pay to pension, offering pay in lieu of pensions have been dropped as a result of the budget changes.