Basis Period Reform - Are you Prepared?

03.10.2022 , BY Kate Perry

03.10.2022 , BY Kate Perry

Basis Period Reform is probably one of the most significant changes to the tax system since the introduction of self-assessment in 1996/97.

For those of you who currently run your accounts to a 31st March year end, there is no need to be concerned with this reform, as your accounts already correspond to the tax year. Similarly, if you have a limited company, this is not relevant to you either. However, for those of you who do not have this year end, you may be interested to hear that next year is the time to change to a March year end.

The Current System

Currently, those of you who do not have a 31st March accounting year end, will show information on your tax return for the accounting year which ends in the tax year. For example, a 30th June 2022 year end, will declare those profits in the 2022/23 tax year as 30th June falls between 6th April 2022 and 5th April 2023. This does, however, give you the advantage of effectively, having a nine-month delay in paying your tax compared to a practice with a 31st March year end who will declare their profits for 31st March 2023 in the same tax year, 2022/23.

The government are now wanting to assess all profits which actually fall within the tax year, so that no one pays tax in arrears. This is all in preparation for Making Tax Digital (MTD), when nearly all businesses will be required to submit information to HMRC on a quarterly basis.

However, many of you may well have already thought about changing your year end to 31st March to correspond to the tax year, for mere simplification but also, as that is the NHS year end and so it makes preparing your accounts much less complicated. We know that clients are often confused when we ask for expenses to their accounting year end, to say 30th September to match with the practice accounting year end, but we need their bank interest, rental income or pension contributions to 5th April.

In the past, those looking to change their year end may have been put off by the additional tax which arises, or at least the long-standing partners in the practice will have been.

When the Change will Come into Effect

The change will take effect from 6th April 2024, so the 2024/25 tax year, which is when your profits must align with the tax year. Therefore, the transitional year, where you will move from your non-March year end will be in the 23/24 tax year. We will be recommending that all clients run a set of accounts to 31st March 2024, so that they will be in line with the tax year for the 24/25 tax year. This is a year when you will have to declare earnings for your usual accounting year, together with the profits from that date to 31st March 2024. Returning to the example of a June year end, this would mean declaring income for the 12 months to 30th June 2023 and the 9 months to 31st March 2024, so, 21 months of profits. However, you do get some allowance against this, called overlap relief.

Overlap Relief

To understand overlap relief, we need to go back to when you joined your partnership. If you join a partnership which does not have a 31st March year end, there are special rules for the first three tax years.

Year 1 – profits from when you join the partnership to the next tax year end to 5th April

Year 2 – first twelve months

Year 3 – the accounting year end falling in the tax year

You can see from the above that Years 1 and 2 use the same profits, as the first twelve months will always include the profits taxed in year 1. Those same profits are taxed in to different tax years and those duplicated profits are your overlap profits. These will always relate back to the date you joined the practice or to 1996/97 if you joined your partnership before then, as this is when tax started to be assessed on current year, as opposed to prior year profits. This sounds rather complicated but this figure should be recorded on your tax return.

Transitional Year Calculations – 2023/24

So, in the transitional year, in which additional profits will be assessed, you can use your overlap profits to offset those additional profits. However, the main issue with overlap profits is that they were not index linked and so did not increase with inflation. Often profits from twenty or thirty years ago were significantly less than those of today.

Example – 30th June Year End

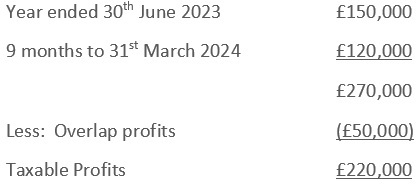

A GP has overlap profits of £50,000 (equivalent to 9 months of profit when they joined). Their profits for the year ended 30th June 2023 are £150,000 and their profits for the 9 months to 31st March 2024 are £120,000.

Tax Return Entries

This means that there is additional taxable income of £70,000 over what would have been the normal taxable income for 2023/24. Previously, this would have been taxed in the year of change and was often the reason for practices with partners who joined a long time ago, deciding not to change their year end as the additional tax which would need to be paid was too onerous. However, with this forced change, the government are allowing you to spread those excess profits over five years, so reducing the additional tax to £14,000 over the next five years. Therefore, the declared profits for 2023/24 will be £164,000 as opposed to £220,00.

NB This option to spread the excess profits is only available if the change to a 31st March year end is in the tax year 2023/24 but you can choose how to spread them, evenly over the five years or more in some years than in others.

Planning Considerations

Retiring GPs, Mergers, Cessations

With these situations, you may wish to delay the change to coincide with these transitional year spreading options. Retiring GPs or the cessation of business will crystallise the excess profits meaning that they will all be taxed in the final year, whether that is now or the remaining balance after 2023/24.

Changes in income due to session changes

If a GP has consistently earned profits of below £100,000 but they increase their sessions which increases their profits to over £100,000, they could choose to use more of their excess earnings if this means that they remain below £100,000 to minimise tax to bring the earnings up to £100,000. Alternatively, if the excess profits cause them to exceed £100,000 for every one of the five year’s spread, then they could choose to take the hit in year 1, allowing them to remain below £100,000 for the following years, which means they can retain the Personal Allowance of £12,570.

It will all depend on what the profits are for each year. It may also be a different decision for different partners.

Practices who pay partners’ tax

There may be cash flow implications for practices who pay tax on behalf of partners and so it will be important to consider holding back more drawings to enable the practice to pay this extra tax.

Pension Implications

There are also pension overlap profits in respect of pensions which work in a similar way to the tax overlap. However, we don’t yet know if the pension overlap rules will be changed to reflect the tax rules in respect of potentially spreading the additional pension contributions arising on the additional taxable income. These will, of course, be allowable to offset against your profit. So, some planning in respect of this will also be required.

Please remember that everyone’s situation will be different between practices and between the partners within each partnership. However, RBP have already started monitoring the situation and we shall be here every step of the way to advise on what the best course of action is for you.